You can use different sets of figures depending on what you are trying to achieve. In business, this would typically mean debits recorded on a balance sheet and credits on an income statement. In single-entry bookkeeping, every transaction is recorded just once (rather than twice, as in double-entry bookkeeping), as either income or an expense. Single-entry bookkeeping is less complicated than double-entry and may be adequate for smaller businesses.

- In this method, estimates of historical account activity levels and other metrics are used.

- Business owners working in construction or manufacturing may be especially drawn to Sage 50’s advanced inventory, job costing, reporting and budgeting capabilities.

- This should be recorded in the reconciliation and noted in the records, which should be updated.

Sarah Ferguson Sets the Record Straight on Prince Andrew Reconciliation Rumors: ‘Happy as We Are’

It will let you see if the goods you sold or services you provided match up with your internal records. This generally takes place at the end of the month as part of the account closing process. This would be immediately before a business puts out its monthly financial statements. secured and unsecured debt You would need to justify, explain, or correct any differences or discrepancies. When there are no unexplained differences, an accountant is able to sign off the process. We refer to them as bank, vendor, customer, business-specific, and intercompany reconciliation.

AWS Security Fundamentals

It also has excellent reporting features and a capable mobile app as well as a customizable dashboard that lets each user rearrange or hide panels according to their preferences. When you log into Decision Support reports, you will be asked to provide an IBMid. When the screen shown to the right appears, log in with [your UCInetID here]@uci.edu.

What are the Common Discrepancies in Account Reconciliation and How to Solve Them?

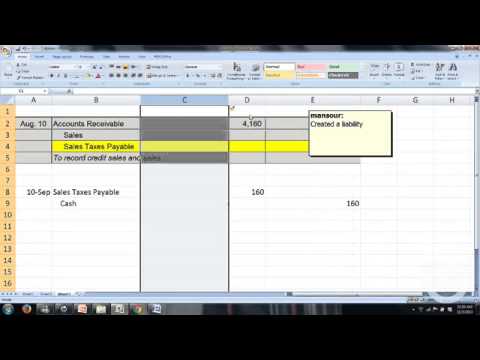

When an account is reconciled, the statement’s transactions should match the account holder’s records. For a checking account, it is important to factor in any outstanding checks or pending deposits. It’s also possible to make a double-entry journal entry that affects the balance sheet only. For example, if a business takes out a long-term loan for $10,000, its accountant would debit the cash account (an asset on the balance sheet) and credit the long-term debt account (a liability on the balance sheet).

For the current year, the company estimates that annual revenue will be $100 million, based on its historical account activity. The company’s current revenue is $9 million, which is way too low compared to the company’s projection. While scrutinizing the records, https://www.wave-accounting.net/ the company finds that the rental expenses for its premises were double-charged. The company lodges a complaint with the landlord and is reimbursed the overcharged amount. In the absence of such a review, the company would’ve lost money due to a double-charge.

End-to-end security and guidance

This report can also be used to review and select object codes or KFS accounts when preparing KFS eDocs. The UC Common Chart of Accounts Report can help you better understand how UC Irvine’s chart of accounts translates to the new UC Common Chart of Accounts (CCoA). Again, this should be recorded and noted in the records, https://www.business-accounting.net/it-equipment/ which should be updated. Account reconciliation is usually performed by financial professionals such as accountants, bookkeepers or finance officers. This insights and his love for researching SaaS products enables him to provide in-depth, fact-based software reviews to enable software buyers make better decisions.

Accounts like prepaid expenses, accrued revenues, accrued liabilities, and some receivables are reconciled by verifying the items that make up the balance. This may be done by comparing a spreadsheet calculation to the balance in the general ledger account. Once you have a solid starting point, look at the reconciling items in last period’s ending balances. No matter how diligent the accounting team is, sometimes a transaction just slips through the cracks.

The free version of the accounting software lets you track income and expenses, send unlimited invoices and automatically send reminders for late online payments. It also gives you access to more than a dozen pre-built financial reports, including a profit and loss statement and balance sheet. Reconciling accounts and comparing transactions also helps your accountant produce reliable, accurate, and high-quality financial statements. A reconciliation is the process of comparing internal financial records against monthly statements from external sources—such as a bank, credit card company, or other financial institution—to make sure they match up.

During reconciliation, you should compare the transactions recorded in an internal record-keeping account against an external monthly statement from sources such as banks and credit card companies. The balances between the two records must agree with each other, and any discrepancies should be explained in the account reconciliation statement. To ensure accuracy and balance, the process of account reconciliation involves comparing the balances of general ledger accounts for balance sheet accounts to supporting sets of records and bank statements. Additionally, rolling schedules are maintained with beginning balance, additions, reductions, and ending balance for specific accounts. One account will get a debit, and the other account will receive a credit for the same transaction.

The account reconciliation process also helps to identify any outstanding items that need to be taken into consideration in the reconciliation process. Most importantly, reconciling your bank statements helps you catch fraud before it’s too late. It’s important to keep in mind that consumers have more protections under federal law in terms of their bank accounts than businesses.

And because it’s a cloud-based system, you’ll be able to access your real-time accounting and other business data on the go from anywhere. Striven’s accounting software will also help ensure your business is operating in a tax-compliant manner by automating tax calculations and giving you access to various tax reports. Delays in vendor reconciliation can affect cash flow management and strain vendor relationships. Nanonets automates the reconciliation process, ensuring that it is completed promptly. Timely reconciliation helps businesses manage cash flow more effectively and maintain healthy relationships with their vendors by ensuring on-time payments. Identify which items are present on the vendor statements but not in the accounts payable ledgers.